How Modern Portfolio Theory Should Help You Build a Product Roadmap

You should have a blend of bets - be smart about building the roadmap

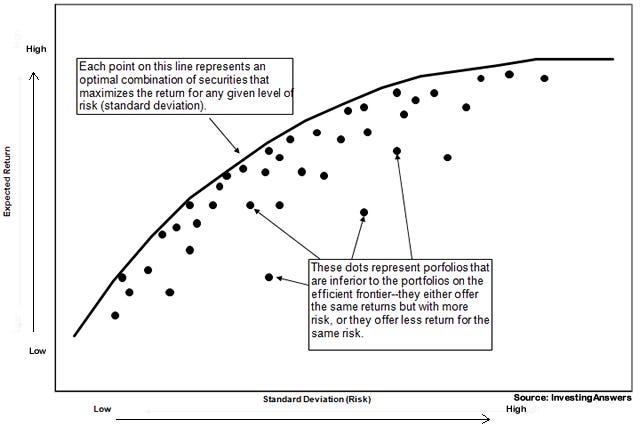

When building a product roadmap, it’s tempting to focus on either short-term gains or long-term moonshots. However, a well-balanced roadmap should take inspiration from modern portfolio theory (MPT), which suggests diversifying investments across different risk and return profiles. By applying this principle to product development, you can create a roadmap that balances immediate wins with long-term breakthroughs, ensuring sustained growth and innovation.

The Need for Balance

Much like in investing, product development benefits from a diversified approach. You need both:

Short-term bets: Initiatives that have a high probability of success and can drive immediate growth.

Medium-term extensions: Expanding your existing product to unlock new user segments or increase engagement.

Long-term investments: High-risk, high-reward projects that could fundamentally change your growth trajectory.

An imbalanced portfolio—one skewed too much toward quick wins or only focused on ambitious long-term goals—can stifle sustainable growth. A well-structured roadmap ensures that while you optimize today, you’re also planting the seeds for future breakthroughs.

Short-Term Bets: Maximizing Immediate Impact

Short-term bets should focus on high-confidence opportunities that improve the core product. These include:

Low-hanging fruit within your existing growth loop: Simple optimizations based on clear user pain points.

A/B testing (if you have enough traffic): Experimenting with different variations to fine-tune conversion rates and engagement.

Customer-driven optimizations: Insights from direct interactions with users and data analytics should guide tweaks that enhance the experience.

Everything in this category should be grounded in clear hypotheses and validated through rigorous testing and analysis. The goal here is to generate quick wins that sustain growth while setting the stage for medium and long-term bets.

Medium-Term Extensions: Finding New Growth Opportunities

Beyond immediate optimizations, a strong roadmap should include medium-term initiatives that extend your product in meaningful ways. These typically involve:

Feature extensions: Adding adjacent functionality that enhances your core offering.

New user segments: Identifying and targeting customer groups who could benefit from your product with minor modifications.

Integration opportunities: Understanding how users interact with your product in their broader workflow and addressing unmet needs.

To find the right medium-term bets, you need to talk to customers about how they’re using your product, what alternatives they’re using, and what problems they still face. This helps you identify natural expansion opportunities that deepen engagement and widen your market reach.

Long-Term Investments: Bending the Growth Curve

Finally, long-term investments are crucial for staying ahead of the competition and ensuring future growth. These initiatives include:

New product categories: Expanding into adjacent spaces that align with your core business.

Major platform shifts: Exploring emerging technologies that could redefine your industry.

Disruptive innovations: Pursuing transformative ideas that could become new growth engines.

These bets are riskier and take longer to materialize, but they’re necessary to prevent stagnation. The key is to balance them with your short and medium-term investments so that even if some fail, the business continues to grow.

The Importance of Portfolio Allocation

A well-balanced product roadmap isn’t overloaded with just short-term optimizations or moonshot ideas. If you focus solely on short-term wins, you’re merely optimizing an existing system without laying the foundation for future expansion. Conversely, if you invest only in ambitious long-term projects, you risk missing immediate opportunities and delaying returns for too long.

The goal is to create a self-sustaining innovation cycle: short-term wins drive immediate growth, medium-term investments expand the market, and long-term bets set the stage for future success. Over time, successful medium and long-term projects become the next set of short-term optimizations, continuing the cycle.

Conclusion

By applying modern portfolio theory to product roadmapping, you can ensure a strategic mix of short, medium, and long-term bets. This balanced approach allows you to sustain current momentum while continuously opening up new growth opportunities.

A great product roadmap isn’t just a to-do list—it’s a diversified investment strategy for your company’s future. By thoughtfully allocating resources across different time horizons, you can drive both immediate success and long-term breakthroughs, ensuring that your product continues to evolve and thrive in an ever-changing market.